Buffett’s Latest Move in the Stock Market

Warren Buffett (Trades, Portfolio), through Berkshire Hathaway, has made a notable addition to its investment portfolio by acquiring 50,682,902 shares of Liberty SiriusXM Group (NASDAQ:LSXMK) on March 6, 2024. This transaction saw an increase of 2,183,430 shares at a trade price of $29.26, reflecting a 0.02% trade impact on Berkshire’s portfolio. The position in LSXMK now accounts for 0.43% of the firm’s holdings, with a significant 15.52% ownership of the traded stock.

Warren Buffett (Trades, Portfolio): Investment Titan

Warren Buffett (Trades, Portfolio), the Chairman of Berkshire Hathaway, is a legendary figure in the investment world, often referred to as “The Oracle of Omaha.” His investment philosophy, deeply influenced by Benjamin Graham, emphasizes value investingacquiring companies at prices less than their intrinsic value and holding them for the long term. Berkshire Hathaway, originally a textile company, has been transformed under Buffett’s leadership into a massive conglomerate with a focus on insurance and other diverse business interests. The firm’s top holdings include prominent names such as Apple Inc (NASDAQ:AAPL), American Express Co (NYSE:AXP), and Coca-Cola Co (NYSE:KO), with a total equity of $347.36 billion and a strong inclination towards the technology and financial services sectors.

Liberty SiriusXM Group at a Glance

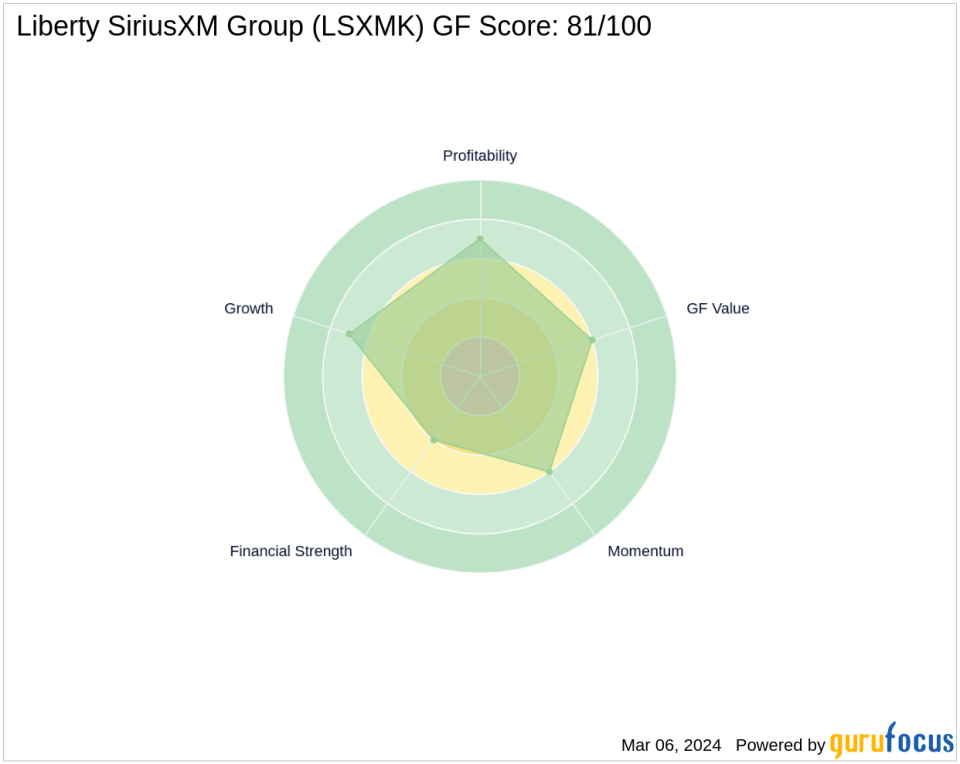

Liberty SiriusXM Group, operating primarily through its subsidiary Sirius XM Holdings, is a powerhouse in subscription-based satellite radio services. The company, which went public on April 18, 2016, offers a wide array of music, sports, entertainment, and other programming across the United States and the United Kingdom. With a market capitalization of $9.57 billion and a stock price of $29.25, LSXMK is considered fairly valued with a GF Value of $31.32. The stock’s PE Percentage stands at 12.79, indicating profitability, and it boasts a strong GF Score of 81/100, suggesting good potential for outperformance.

Impact of Buffett’s Trade on Berkshire Hathaway

The recent acquisition of LSXMK shares by Berkshire Hathaway is a strategic move that further solidifies the firm’s position in the media-diversified industry. The additional shares represent a modest yet strategic increase in Berkshire’s portfolio, which could signal Buffett’s confidence in the long-term prospects of Liberty SiriusXM Group. The trade’s significance is underscored by the 15.52% stake that Berkshire now holds in the company, making it a substantial investment within the firm’s diverse portfolio.

Market Valuation and Stock Performance

Liberty SiriusXM Group’s current market valuation aligns closely with the GF Value, with a Price to GF Value ratio of 0.93. The stock has experienced a slight decline of 0.03% since the transaction date, yet it has seen a significant increase of 36.94% since its IPO. The year-to-date performance shows a marginal change of 0.07%. These metrics, combined with the company’s GF Score, suggest a stable investment with the potential for growth.

Industry Insights and Competitive Standing

In the media-diversified sector, Liberty SiriusXM Group holds a competitive position. The company’s financial health, as indicated by its Financial Strength rank of 4/10 and interest coverage rank of 448, is complemented by a Profitability Rank of 7/10. The company’s Operating Margin growth and Growth Rank both stand at 7/10, indicating a strong potential for future earnings expansion.

Other Prominent Investors in LSXMK

Aside from Berkshire Hathaway, other notable investors such as Seth Klarman (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio) have also taken an interest in Liberty SiriusXM Group. Their involvement underscores the attractiveness of LSXMK as an investment opportunity within the media-diversified industry.

Concluding Thoughts on Buffett’s Investment Strategy

Warren Buffett (Trades, Portfolio)’s recent investment in Liberty SiriusXM Group is a testament to his value investing strategy and his ability to identify companies with strong long-term prospects. For value investors, Buffett’s moves offer insights into potential market opportunities and the importance of thorough analysis when selecting stocks. As Berkshire Hathaway continues to adjust its portfolio, the investment community will undoubtedly watch closely to glean wisdom from one of the most successful investors in history.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.